In 2021, electricity prices rose by their highest rates in over a decade. Though the average rate of this increase appeared small (at only 4.3%,) the understanding of this increase is just starting to be realized. Utility companies often attempt to minimize the impact of this news by publishing the rates in the standard kWh format, which makes the percentage increase seem like it has less of an impact than it actually does. At a glance, consumers see half a cent increase here or there, but fail to see the steady climb that has been made by utility costs over time.

This steady climb in prices especially weighed heavily on customers during the wintertime, driving many customers around the country into a ‘past due’ account status. According to the National Consumer Law Center, some states now have outstanding utility debt from unpaid accounts totaling 500 million dollars. With recent worldwide events adding to inflation, costs don’t appear to be going down anytime soon.

With household budgets already overextended, natural gas shortages and colder weather seem to be teaming up to add insult to injury. On top of all this, many of the protection programs from the ongoing pandemic are set to expire. This means that shutoffs will begin to occur, leaving an already financially overextended customer base to the mercy of whatever taxpayer programs states can come up with.

Most experts agree that rising natural gas prices are a major contributor to the increase in utility bills. Though some of this is due to the increasing difficulty to harvest the non-sustainable fuel, increased investments in the distribution of the coveted substance are also to blame. While certain financial experts continue to recommend such investments in dwindling resources like natural gas, coal, and oil, the average American worker continues to spiral into debt. Customers struggling with job loss due to a global pandemic, now must suffer the consequences of the greed-filled need for a positive return from Wall Street.

This type of inflation is nothing new, and history has shown that it consistently leads to a spiral of protection policies for low-income families and taxation increases for those that need to cover the extra expense. Relief programs and funding will inevitably fall on the shoulders of the blue-collar worker, as it has done time and time again. Protect the investments of the wealthy but continue to inflate the cost of a non-replenishable resource; all at the cost of the working class. Thus far, this mindset seems to be the American way. In fact, when asked about these issues, the Edison Electric Institute (a company that represents investor-owned utilities,) declined to comment.

Nonetheless, like many of today’s issues, what we need is consistent reliable data. In order to understand the scope of these increasing prices, and just how damaging they are, we have to have a better idea of what factors weigh into what’s occurring. Regardless of the reason, one thing is certain: past due accounts and threats of shut offs are consistently on the rise. Whether the culprit is due to investment greed, transport costs, acquisition of rapidly depleting resources, or unemployment, the end result is billions of dollars in delinquent bills and impending shut offs for those families already struggling nationwide.

Winter of 2022 saw an increase in utility costs in some cities of up to 70%, and with the current state of world events, Spring doesn’t seem as though it will be bringing its usual relief. Some economists even believe that as long as there’s a dependency on dwindling resources like natural gas and oil, that the customer will be paying the ultimate price for years to come. Non-renewable sources of fuel are becoming harder and harder to find, and it is now certain that it is not a matter of “if” we will run out of these resources, but “when.”

One can argue that the most pertinent question that Americans now face when it comes to their utility bills, is: “Can we afford to support the consistent inflation costs required to acquire energy from dwindling non replenishable sources of fuel like natural gas and oil?”

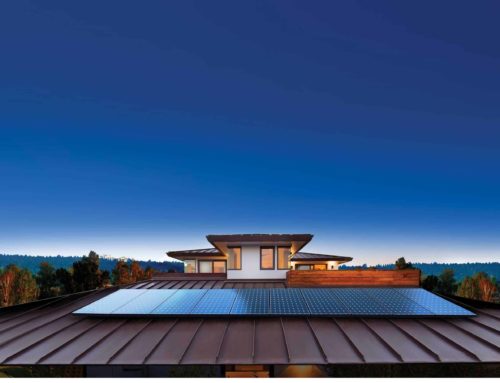

The answer isn’t a simple one. However, with tax incentives, finance programs, and no money out of pocket, it’s no wonder that the appeal of renewable energy (such as solar power) is becoming more and more widespread. In fact, making the move to green energy (like solar) is perhaps more than just a sound financial decision. Perhaps switching to solar is a decision that Americans need to make to simply survive the rising costs of corporate greed, as well as the inevitable world-wide depletion of non-renewable fuel.